Federal marginal income tax rates 2021

The additional 38 percent is still applicable making the maximum federal income tax rate 408 percent. This history is important because it shows that the tax law is always changing.

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

10 12 22 24 32 35 and 37.

. What Are the Income Tax Brackets for 2022 vs. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. The indexation factors tax brackets and tax rates have been confirmed to Canada Revenue Agency information.

Explore 2021 tax brackets and tax rates for 2021 tax filing season. The income ranges. Once a taxpayer has made these determinations he 1 references the pertinent rate schedule 2 finds the appropriate bracket based on her taxable income and 3 uses the formula described in the third column to determine his federal income tax.

The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1024 a 24 increase. These are the federal income tax brackets for 2021 and 2022. For a dividend to be a qualified dividend you must have held the asset for more than 60 days during the 121-day period starting 60 days before the ex-dividend date.

Your tax bracket depends on your taxable income and your filing status. Federal Individual Income Tax Rates and Brackets. Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37.

Your tax bracket is the rate you pay on the last dollar you earn. The Arizona income tax has four tax brackets with a maximum marginal income tax of 450 as of 2022. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

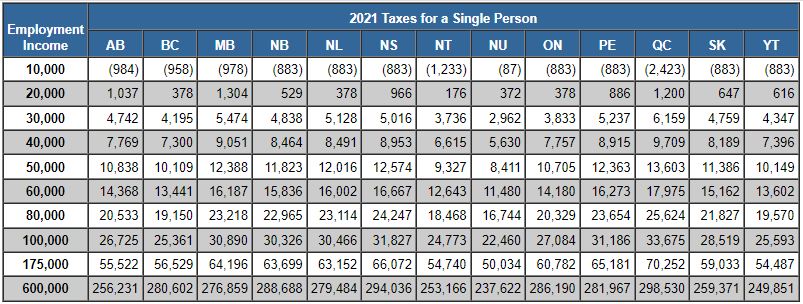

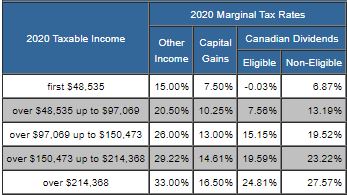

Canada 2021 Marginal Tax Rates. Detailed Louisiana state income tax rates and brackets are available on this page. As of 2022 there are seven marginal tax rates or brackets.

Please read the article Understanding the Tables of Personal Income Tax Rates. 10 12 22 24 32 35 and 37. The State of California Tax Franchise Board notes that for tax year 2020 households making up to 30000 could qualify for a tax credit of up to 3026.

10 12 22 24 32 35 and 37. Assume for example that Taxpayer A is single and has a taxable income of 175000 in 2021. Detailed Arizona state income tax rates and brackets are available on this page.

These tax rates are the same for 2022 but they apply to different income levels than in 2021. What this Means for You. These are the federal income tax brackets for 2021 and 2022.

But as a percentage of your income your tax rate is generally less than that. There are seven tax brackets for most ordinary income for the 2021 tax year. There are seven federal tax brackets for the 2021 tax year.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. Your bracket depends on your taxable income and filing status. 2021-2022 federal income tax brackets rates for taxes due April 15 2022.

The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are responsible for supporting yourself. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly. Depending on your taxable income you can end up in one of seven different federal income tax brackets each with its own marginal tax rate.

Qualified dividend income refers to income held for a certain period. Imposes tax on income using by graduated tax rates which increase as your income increases. First here are the tax rates and the income ranges where they apply.

You can check its website for 2021 updates. Canada 2022 Marginal Tax Rates. Year Rates Brackets Rates Brackets Rates Brackets Rates Brackets.

See chart at left. These are the rates for taxes due. Ontario 2022 and 2021 Personal Marginal Income Tax Rates The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1024 a 24 increase.

These gains are taxed just the same as ordinary income so you can refer to the federal income tax rates above. Last law to change rates was. Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone.

In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer Head of Household Notes. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. The Louisiana income tax has three tax brackets with a maximum marginal income tax of 600 as of 2022.

State Corporate Income Tax Rates And Brackets Tax Foundation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Personal Income Tax Brackets Ontario 2021 Md Tax

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Personal Income Tax Brackets Ontario 2020 Md Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Taxtips Ca 2021 Tax Comparison Employment Income

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Abbotsford News

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Taxtips Ca Federal 2019 2020 Income Tax Rates

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Personal Income Tax Brackets Ontario 2019 Md Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips